Ep. 196- Paul Fenner - How Parenting Challenges Shape Real-World Financial Advice

Have you ever thought about the moments that help shape your beliefs and emotions?

I want to share how being a dad to triplets (plus one!) has completely reshaped how I think about financial planning.

From cheering at swim meets to navigating tough parenting moments, I've learned that raising kids isn't so different from guiding families through financial decisions. Both are emotional, both are messy at times, and both require a ton of empathy.

I'll share some personal stories that changed how I work with clients — how understanding someone's money story is just as important as crunching the numbers. And how learning to manage expectations (my kids, my clients, and my own) has made me a better advisor — and a dad.

One key point I hope you takeaway is that emotional awareness — not just financial knowledge — can help you make better decisions for your family's future.

If you've ever felt the weight of trying to do it all — save for college, plan for the future, and still be present with your family — this one's for you.

Connect with Paul

Contact Paul here or schedule a time to meet with Paul here.

Follow Paul on LinkedIn, Instagram, and Facebook.

And feel free to email Paul at pfenner@tammacapital.com with any feedback, questions, or ideas for future guests and topics.

ADDITIONAL RESOURCES YOU MAY LIKE

1 Big Idea to Think About

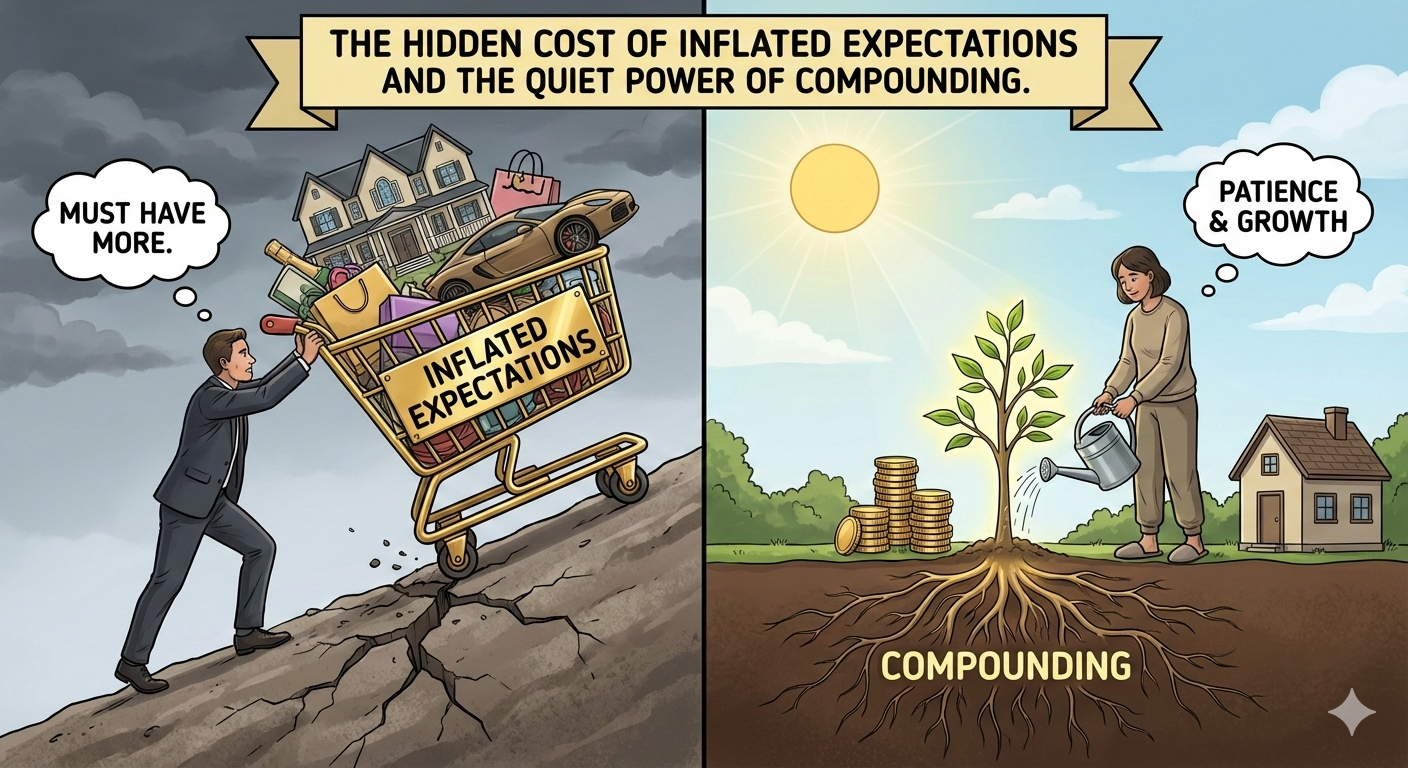

Our emotions deeply influence our financial decisions, and finding emotional balance—by understanding our personal stories and setting realistic expectations—can lead to more meaningful and successful financial planning.

1 Way You Can Apply This

To create a more meaningful and resilient financial plan, focus on understanding the personal and emotional stories behind your financial decisions—both yours and your family’s. By approaching money conversations with empathy and realistic expectations, you can better navigate priorities like retirement and college planning, ultimately building a plan that aligns with your true values and promotes lasting happiness.

1 Question to Ask

Are my expectations for my financial goals—like saving for retirement, college, and enjoying life—realistic, and how can I adjust them to better fit my current reality and emotional well-being?

Key Moments From the Show

00:01 Reflecting on wanting to be an advisor but never wanting to be a father; now father of triplets plus one.

00:53 Story about supporting his daughter and another swimmer during an emotional swim meet.

01:54 Parenting experiences build empathy and understanding, making him a better advisor.

02:59 Parenting creates a village—parents lean on each other for support and guidance.

04:01 Advising families goes beyond money—emotions and personal stories are deeply intertwined with financial decisions.

04:54 Empathy and listening are more effective than lecturing clients about money habits.

06:05 Balancing expectations and reality in both sports and finances; happiness equation: happiness = reality - expectations.

07:07 Success comes from setting realistic priorities; “You can do most things, but not all.”

08:07 Adjusting expectations for saving, spending, and lifestyle; creating a plan that fits both emotional and financial needs.

Resources Featured in This Episode:

Cutting Through the Noise: Removing Distractions for Decision Making

The Impact of Politics on Financial Planning: Navigating Market Trends