Ep. 197 – Paul Fenner – Focusing on What Never Changes

We live in a world obsessed with what’s new. The latest tech, the next headline, tomorrow’s market forecast. But beneath all that noise, some things stay the same. And maybe—just maybe—that’s where the real wisdom lies.

Born out of a moment of reflection after a volatile April in the financial markets, I found myself returning to Morgan Housel’s work, especially his book Same as Ever. It reminded me that the most important lessons aren’t about predicting the next move—they’re about understanding the truths that don’t change.

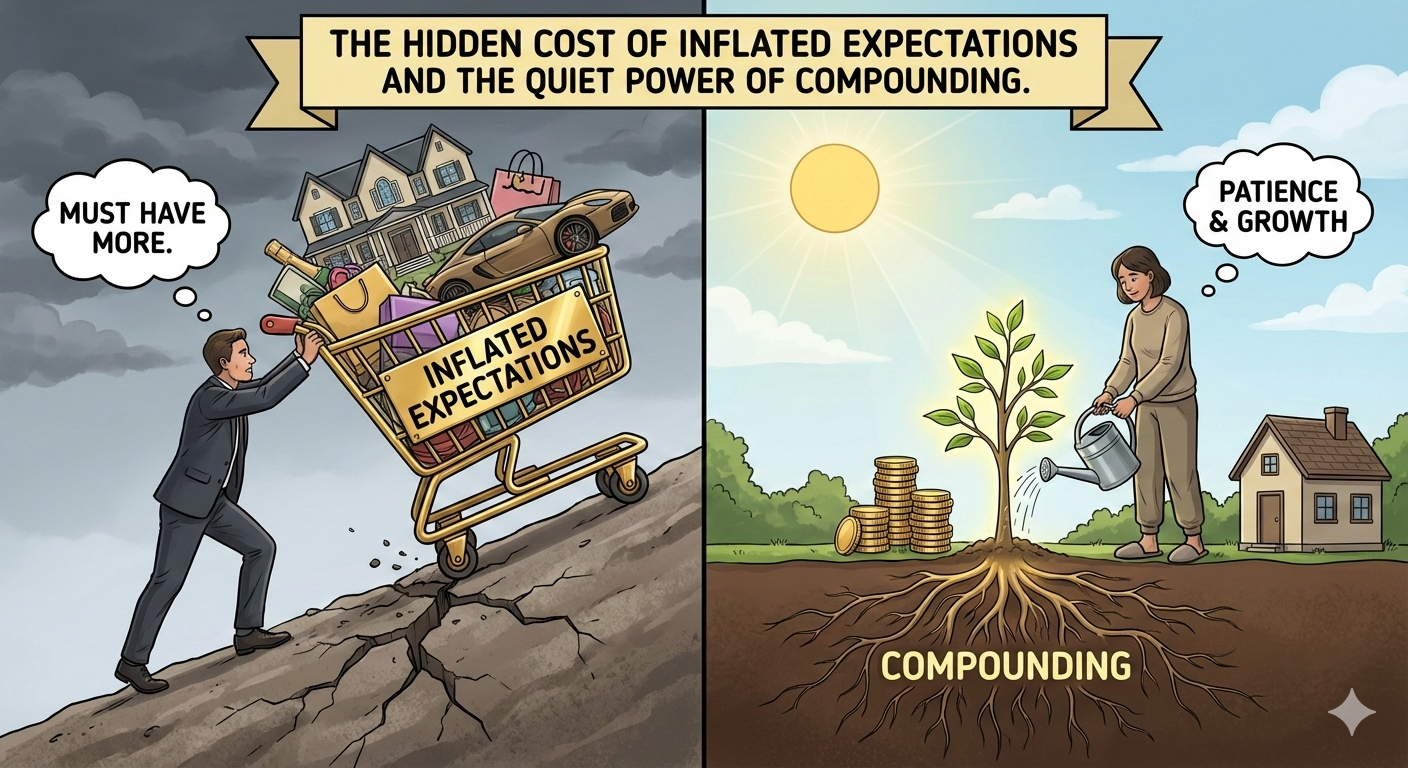

In this episode, I highlight five timeless ideas that I believe are always worth remembering: the constancy of human emotion, the quiet power of compounding, the weight of expectations on our happiness, the surprise of risk, and the challenge of holding two competing ideas—like optimism and pessimism—in balance. These aren’t hot takes. They’re not meant to be. They’re principles that have held up over decades and likely will hold up for decades more.

So, if you’ve been feeling overwhelmed by all that’s shifting, I invite you to slow down with me—and focus on what never changes.

Connect with Paul

Contact Paul here or schedule a time to meet with Paul here.

Follow Paul on LinkedIn, Instagram, and Facebook.

And feel free to email Paul at pfenner@tammacapital.com with any feedback, questions, or ideas for future guests and topics.

ADDITIONAL RESOURCES YOU MAY LIKE

1 Big Idea to Think About

While life and the markets are full of uncertainty and constant change, focusing on timeless principles, like understanding human nature, the power of compounding, and maintaining realistic expectations, can help us make better decisions and find greater contentment.

1 Way You Can Apply This

To help navigate periods of financial uncertainty, remind yourself that human emotions like fear and greed are timeless drivers of market swings. By acknowledging these emotions and focusing on steady, positive habits such as consistent saving and appreciating what you have, you can build lasting resilience and make more balanced financial decisions, even when the markets or life feel unpredictable.

1 Question to Ask

What are the timeless principles or habits in my own life that I can focus on—regardless of how much things around me change?

Key Moments From the Show

00:48 April 2025 was volatile in the markets due to tariffs, but markets surprisingly recovered by month-end.

02:08 First lesson—human nature is constant: greed and fear never change, and emotions fuel market cycles.

02:53 Second takeaway—compounding always works, though slowly; most portfolio growth comes from consistent saving over time.

03:55 Compounding’s effects are invisible day to day but become clear over years; applies to both finances and relationships.

05:15 Third principle—expectations shape happiness more than outcomes; high expectations often lead to disappointment.

05:50 True happiness isn’t about having more, it’s wanting less and appreciating what you have.

06:47 Fourth truth—risk is what you don’t see coming; biggest life events (good or bad) are surprises.

07:53 Fifth insight—the power of duality: "save like a pessimist, invest like an optimist," blending realism and hope for long-term success.

08:46 Despite national pessimism, history shows cycles turn; American resilience underpins progress regardless of who’s in charge.

09:51 Closing reflection: Consider what never changes in your life—emotion, time, expectations, unpredictability—and focus there instead of getting lost in fleeting noise.

Resources Featured in This Episode:

Same as Ever: A Guide to What Never Changes