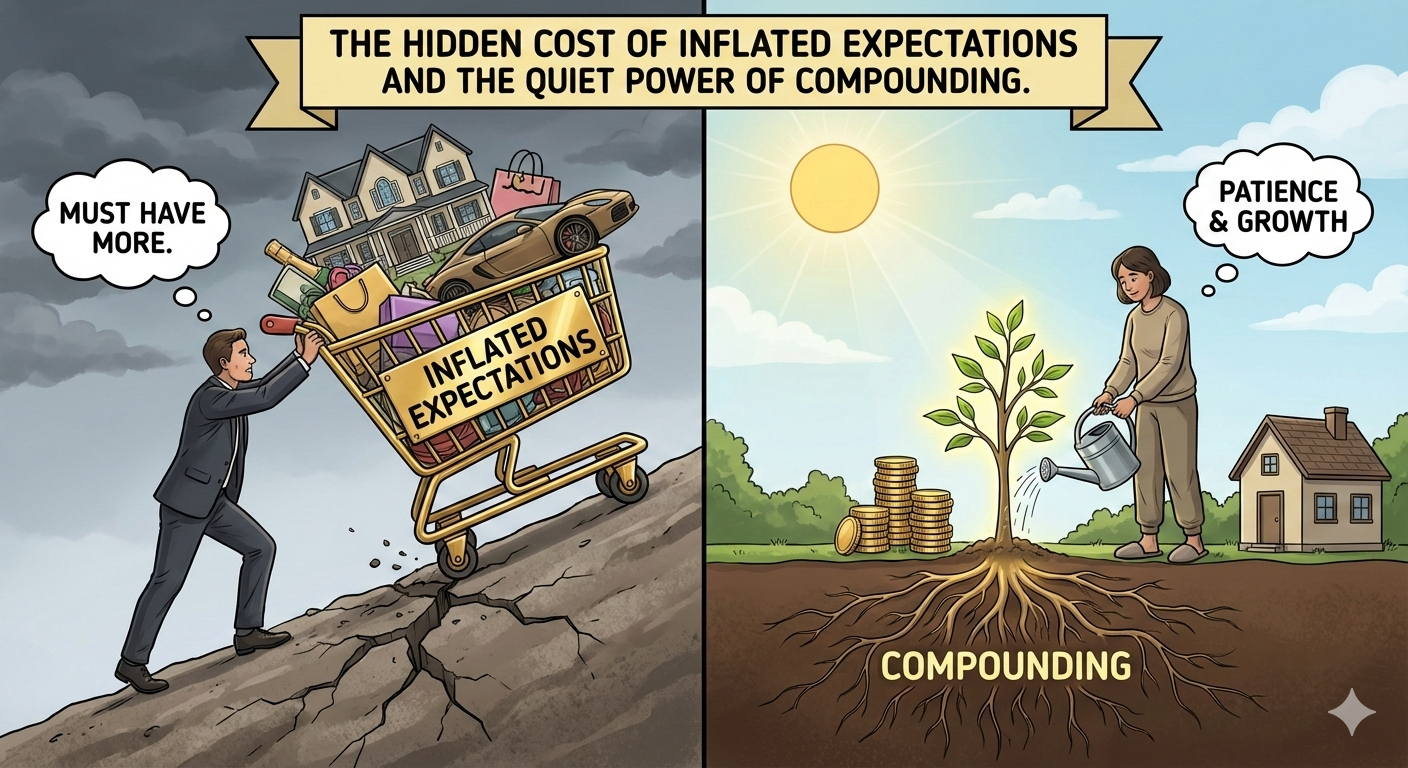

The Hidden Cost of Inflated Expectations

"Today's economy is good at creating two things: wealth, and the ability to show off wealth… We might have higher incomes, more wealth, and bigger homes – but it's all so quickly smothered by inflated expectations."

This is a quote from an article Morgan Housel wrote several years ago about how to stop the goalposts from moving.

This single insight explains more of the stress I see in parents today than any budget, financial plan, or investment strategy ever could.

Because the truth is this:

Parents today aren't struggling because they lack resources. They're struggling because expectations are expanding faster than reality.

And expectations, not money, are often what drive anxiety, guilt, and the feeling of always being behind.

Why Modern Families Feel Behind Even When They're Not

The families I work with are successful by every traditional metric: strong careers, meaningful income, growing portfolios, and clear long-term goals.

Yet many of them feel like they're treading water.

Why?

Because for every improvement, advancement, or milestone… expectations expand just as quickly.

A raise used to mean breathing room. Now it often just means a new baseline.

A new home used to mean stability. Now it often means new comparisons.

A family vacation used to be a luxury. Now it can feel like a requirement.

We've built an economy that doesn't just create wealth. It creates visible wealth, and visibility is its own form of inflation.

How Expectations Quietly Inflate

Expectations inflate in small steps:

"It would be nice to upgrade someday" turns into "Maybe we should upgrade soon"

turns into "It feels like everyone else is upgrading — what are we missing?"

This is how financial anxiety compounds, not because of a lack of money, but because of too much comparison, too many options, and too little margin.

And parents feel this more intensely than any other group.

Your expectations aren't just about you anymore; they're about your kids: their activities, experiences, opportunities, and future.

That creates enormous pressure even when the numbers say you're doing well.

The Story: Progress Without Peace

One family I work with felt like they were constantly falling behind. Yet when we reviewed their financial plan, the story was the exact opposite:

They were ahead on retirement targets.

They were saving consistently for their kids' future.

They had manageable debt and growing income.

Their math looked great. But their mindset was overwhelmed by expectations — their own and everyone else's.

They weren't lacking progress. They were lacking perspective.

Wealth grows at a steady pace. Expectations grow exponentially if you don't manage them.

The Power of Small Beginnings

"Events, like money, compound… and it's never intuitive how big something can grow from a small beginning."

This is the counterweight to inflated expectations. It's also the lifeline for parents who feel stuck.

Why? Because most of what matters in your financial life grows from small behaviors, not big leaps:

saving a little more automatically

staying invested during uncertainty

talking openly about priorities

choosing "good enough" instead of "perfect"

avoiding unnecessary lifestyle creep

sticking to long-term plans

These small behaviors compound into less stress, more stability, clearer decisions, fewer regrets, and stronger financial health.

But here's the key: You can't see compounding while it's happening. You only see the results years later.

This is why expectations feel louder than progress. One is immediate. The other is invisible.

The Real Work: Aligning Expectations With Values

For families, financial peace rarely comes from making more money. It comes from making more aligned decisions.

Three questions help reset expectations:

1. What matters most in this season of our lives? Not every priority can be a priority right now.

2. Are we comparing ourselves to our values or to other people? Most anxiety comes from the latter.

3. What small behavior today would create long-term stability? Compounding doesn't need perfection. It needs consistency.

A Practical Exercise: Deflate Expectations, Increase Compounding

This week, try this two-part reflection:

Step 1: Identify one inflated expectation you've absorbed.

Examples:

"We should be saving more."

"We should upgrade the house."

"We should be doing more activities for the kids."

"We should be further along."

Write it down. Name it clearly.

Step 2: Replace it with one small behavior that will compound.

Examples:

Increase retirement savings by 1 percent.

Add one meaningful family routine each week.

Clarify next year's top three money priorities.

Choose one major decision to delay until you have more clarity.

This shift from expectations to behavior creates an emotional margin that compounding can build upon.

Final Thought

Wealth and expectations compound in opposite directions. One creates freedom. The other creates pressure.

Your job isn't to chase more. It's to guard the quiet, steady behaviors that make your family's long-term life better.

When you focus on compounding instead of comparison, your financial life becomes calmer, clearer, and far more satisfying, regardless of what anyone else is doing.