Ep. 223 – Paul Fenner – Inflated Expectations: The Hidden Force Undermining Financial Peace

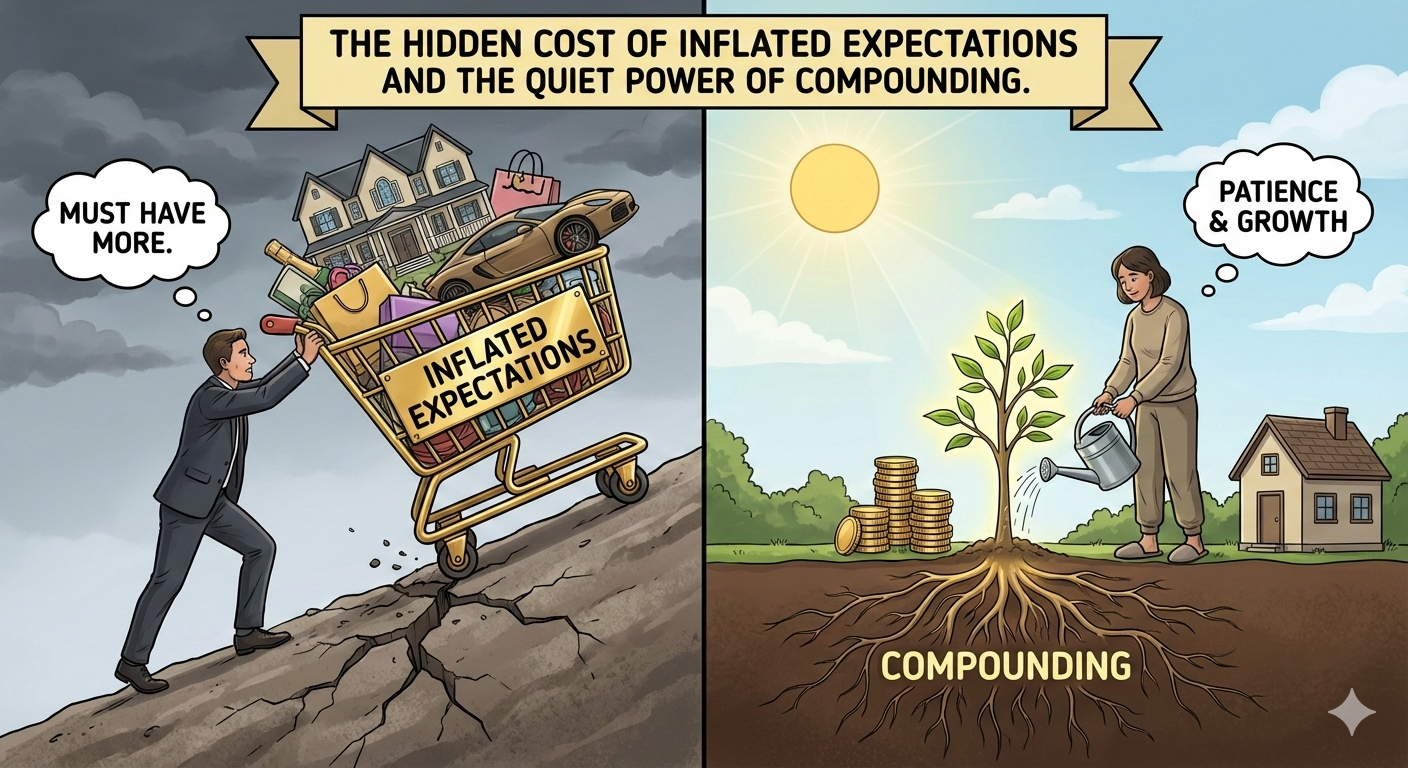

Today’s economy doesn’t just create wealth. It creates the ability to show off wealth, and that visibility inflates expectations so quickly that even high-achieving parents often feel behind, overwhelmed, or financially stretched.

Today, I break down why expectations rise faster than real progress, how that impacts family decisions, and why the small behaviors you repeat consistently are far more important than dramatic financial moves.

If you’ve ever felt like your life looks “successful” on paper but still feels stretched or pressured in real time, you’ll want to hear this episode.

ADDITIONAL RESOURCES YOU MAY LIKE

1 Big Idea to Think About

True financial peace comes from consistently focusing on small, meaningful habits that quietly compound over time, bringing satisfaction and stability. Not from constantly chasing bigger goals or higher expectations.

1 Way You Can Apply This

Shift your focus from inflated expectations to small, steady improvements, such as increasing your savings rate by just 1% or committing to a weekly family dinner without devices. By consistently compounding these modest habits, you'll build long-term stability and emotional well-being, making your financial journey both more meaningful and sustainable.

1 Question to Ask

What current expectation in my financial life is raising my stress more than my satisfaction, and what small, positive behavior could I start compounding instead?

Resources Featured in This Episode:

Getting the Goalpost to Stop Moving

Uncovering Core Values for Financial Clarity and Emotional Balance

You Can Do Most Things, But Not All: A Realistic Approach to Family Goals and Money