Ep. 194 - Paul Fenner - Tariffs, Taxes & Tumult: What Investors Need to Know This Summer

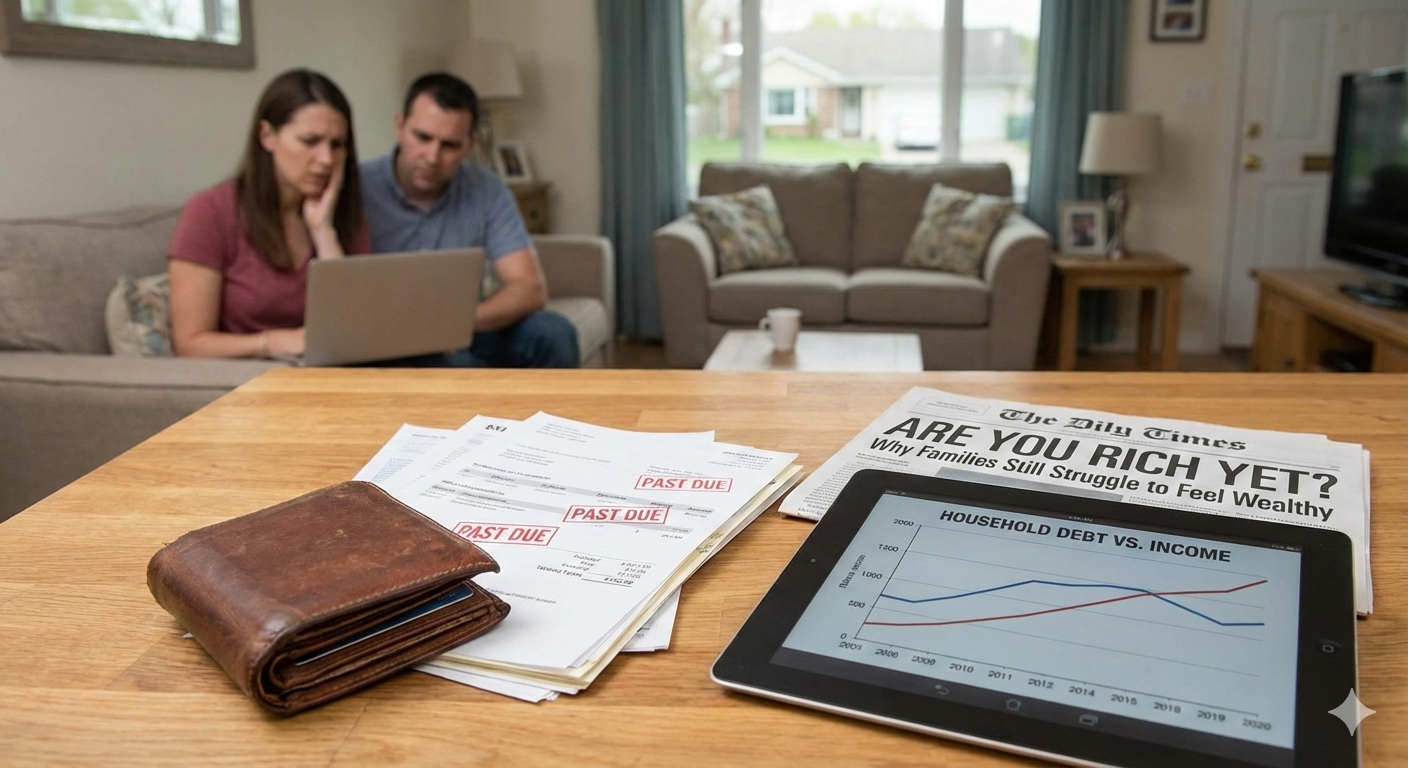

Summer is shaping up to be hot—and not just the weather.

Two words you're going to hear a lot in the coming weeks? “Big Beautiful Bill” and “tariffs.” Yes, they sound like political satire, but they have very real implications for investors and consumers alike.

In this week’s episode of The Emotional Balance Sheet, I talk about:

What’s actually inside the so-called "Big Beautiful Bill" that just passed the House

Why the back-and-forth between the House and Senate may last all summer

How the July 4th deadline coincides with the 90-day tariff pause—and what that could mean for markets

Why I believe many corporations are still in “wait-and-see” mode

The emotional cues to revisit from earlier this spring (think Liberation Day)

But here's the key point: don’t let media noise or political fireworks knock you off your game.

Just like I tell the families I work with—your investment strategy should always be rooted in your long-term objectives and life purpose. Not in the latest headline.

Connect with Paul

Contact Paul here or schedule a time to meet with Paul here.

Follow Paul on LinkedIn, Instagram, and Facebook.

And feel free to email Paul at pfenner@tammacapital.com with any feedback, questions, or ideas for future guests and topics.

ADDITIONAL RESOURCES YOU MAY LIKE

1 Big Idea to Think About

Despite all the noise around new tax legislation and tariffs this summer, the smartest move for investors is to stay calm, focus on their long-term goals, and avoid being swayed by media hype or market swings.

1 Way You Can Apply This

When news about tariffs and tax legislation dominates the headlines, focus on your long-term investment objectives rather than reacting emotionally to market swings. By aligning your portfolio with your personal goals and resisting the urge to make impulsive changes during periods of uncertainty, you create a more resilient investment strategy that supports your financial well-being and peace of mind.

1 Question to Ask

Are my investment decisions and portfolio truly aligned with my long-term purpose and objectives, or am I being swayed by the current headlines and media hype around tariffs and tax legislation?

Key Moments From the Show

00:00 Summer kicks off with two key buzzwords: "big beautiful bill" and tariffs.

00:40 Explanation of how legislation moves between House and Senate; expectation of months-long negotiations.

01:27 Discussion of bill timeline, July 4th deadline, and the coinciding end to tariff pause—possible "fireworks."

01:51 Advice for investors and consumers: Don't react to media fear mongering; stay aligned to your goals.

02:43 Recall emotions from April’s market swings; ensure your strategy still fits your risk tolerance and objectives.

03:33 Medium vs. long-term financial objectives—planning ahead for goals like retirement and college.

03:59 Commentary on media hype surrounding the new tax bill and tariffs; resisting panic.

04:29 Critical take on the new tax bill: mainly extending current tax cuts, adding to national debt.

05:17 Tariffs as an additional tax; uncertainty over their long-term impact; corporations’ cautious approach.

05:58 Corporations waiting to invest or hire, pending tariff decisions—"wild west" of tariffs.

06:24 Assurance to listeners: Staying focused on personalized portfolio management amid uncertainty.

06:47 Close of episode—recap and commitment to align portfolios with family goals.

Resources Featured in This Episode:

Cutting Through the Noise: Removing Distractions for Decision Making

The Impact of Politics on Financial Planning: Navigating Market Trends