Ep. 207 – Paul Fenner – Wins and Losses for New & Growing Families and Parents from the One Big Beautiful Bill

As a busy parent trying to manage your family and career, do you even have time to understand what the new One Big Beautiful Bill will mean to you?

Today, I am going to explore the winds and losses through the “One Big Beautiful Bill” during this pivotal life stage of career and family growth. Drawing from my own experience as a parent of triplets (plus one!), I dive into the financial and emotional challenges parents face when juggling careers, raising children, and planning for the future.

I break down what recent legislation means for families in this life stage, including significant updates to tax brackets, standard deductions, the SALT deduction, child tax credits, dependent care benefits, and the new “Trump account” investment option for kids.

I also share proactive strategies for maximizing FSAs and HSAs, making the most of state-specific and charitable deductions, and finding harmony in your savings plan—no matter what life throws your way.

If you’re feeling pulled in a hundred directions by kids, careers, and finances, or want to stay ahead of the latest tax changes, this episode is packed with real stories, valuable strategies, and honest encouragement to help you build a solid roadmap for your family’s future.

Connect with Paul

Contact Paul here or schedule a time to meet with Paul here.

Follow Paul on LinkedIn, Instagram, and Facebook.

And feel free to email Paul at pfenner@tammacapital.com with any feedback, questions, or ideas for future guests and topics.

ADDITIONAL RESOURCES YOU MAY LIKE

1 Big Idea to Think About

Navigating the career and family growth stage requires embracing both the financial complexities and emotional ups and downs, and that with the right planning and support—even if life throws unexpected challenges your way—you can still find balance and make meaningful progress toward your family’s goals..

1 Way You Can Apply This

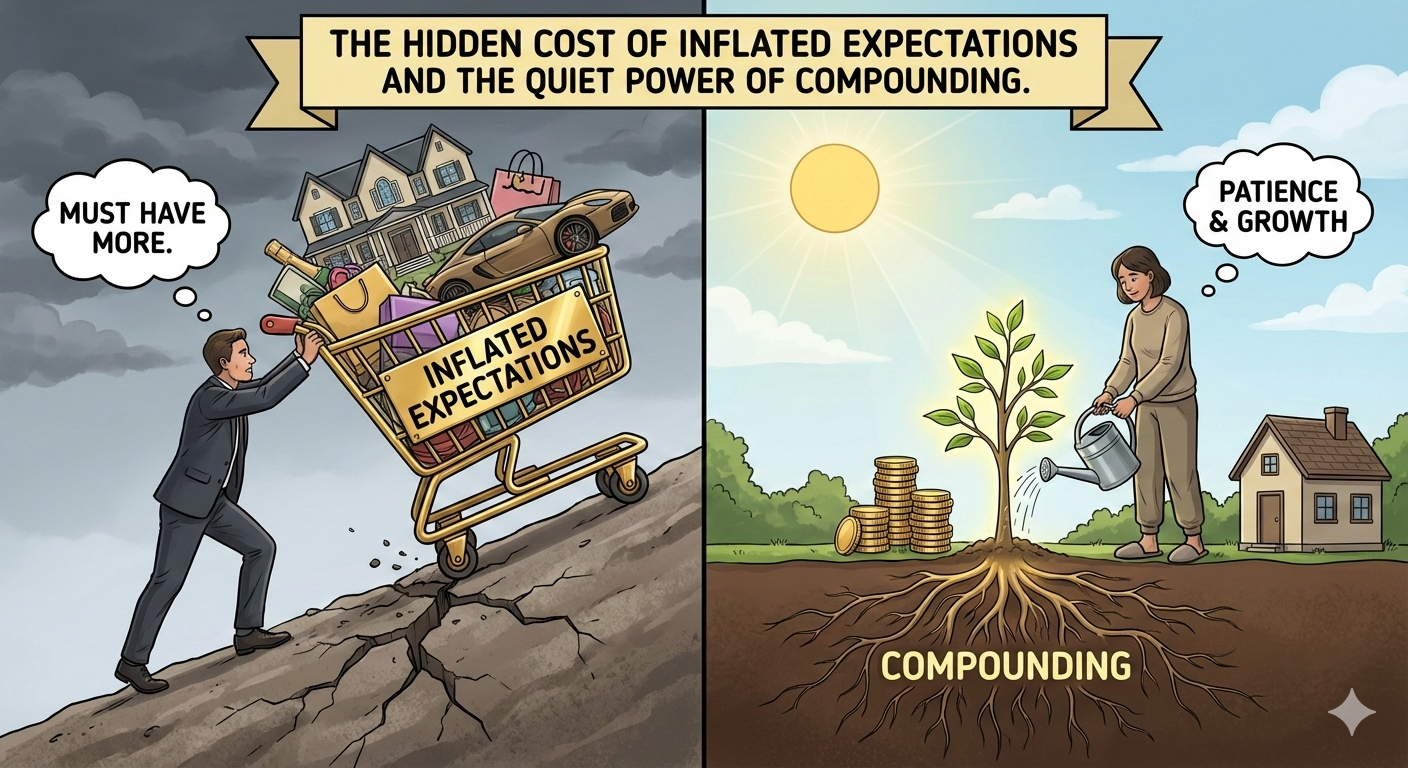

To optimize your family’s financial planning during the busy career and family growth stage, automate your savings contributions—even small monthly amounts can add up over time. By setting up automatic deposits into accounts like 529 plans or retirement funds, you reduce decision fatigue, increase consistency, and make steady progress toward your financial goals, all while freeing up precious mental bandwidth for the priorities that matter most.

1 Question to Ask

Am I taking full advantage of the tax deductions, credits, and savings opportunities available to me during my current life stage, especially as my career and family grow?

Key Moments From the Show

00:00 Life stage "career and family growth" brings unique challenges—raising triplets plus one.

00:53 Parents face physical, mental, personal, and financial demands; "it literally takes a village."

01:50 Standard deduction increased; most people now take standard deduction, lowering taxes for many.

03:10 Tax brackets remain lowered and made permanent—a win for most families.

04:22 SALT (state and local tax) deduction cap increased, but only for 2025-2029; high-income families see phaseouts.

05:45 SALT deduction phases out for married couples earning over $500,000; most still take standard deduction.

08:00 Child tax credit increases to $2,200, but phases out for incomes over $400,000.

09:58 Child and dependent care credit details; eligible expenses explained and income phaseouts described.

11:07 Dependent care FSA contribution limit raised to $7,500—no income phaseout, but requires careful management.

12:04 Importance of HSA (Health Savings Account) for growing tax-advantaged healthcare savings.

14:06 Vehicle loan interest deduction applies to new US-assembled cars, with phaseouts at lower income levels.

15:29 Tax complexity persists due to varying phaseout thresholds and deduction rules.

16:48 Introduction of "Trump accounts" for children—new investment account with potential federal contributions and employer match.

18:59 Trump account particulars—withdrawal rules, tax treatment, and comparison to IRAs and brokerage accounts.

22:49 Many deductions and credits have phaseout cliffs and temporary windows; dual-income families may age out quickly.

23:39 SALT deduction varies widely by state; higher benefit for residents in high-tax states.

24:42 Planning tips: maximize FSA/HSAs, automate savings, review state-specific tax benefits.

25:26 Life changes require financial flexibility; automation helps, but adaptability is key.

27:14 Managing tax brackets, education, and college planning—small, consistent contributions matter.

29:39 Universal charitable deduction now available even with standard deduction.

30:45 Growing a career and family is tough—find a roadmap and right partner to guide your journey.