The Negative Impact to Clients with the Ever Increasing Asset Minimum

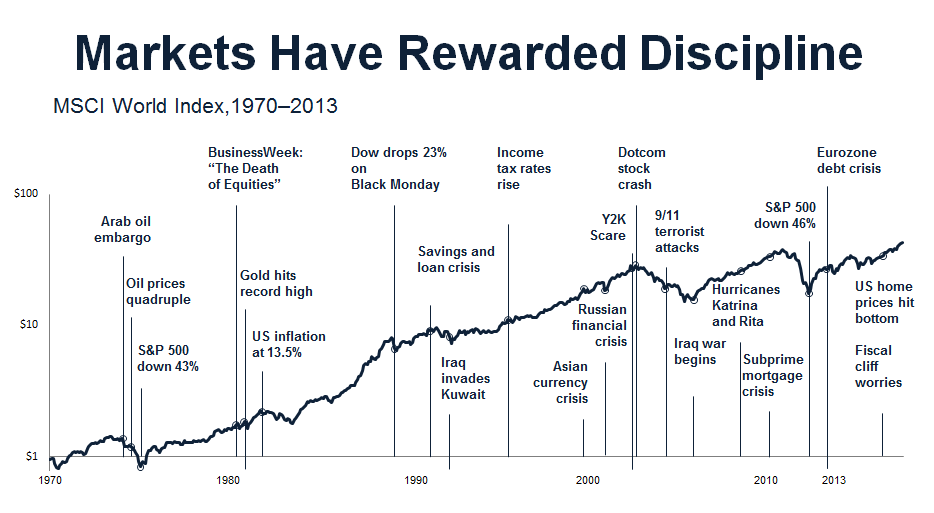

One of the principles that set TAMMA apart from other investment advisory firms was my decision to work with clients of all asset levels. Even though I have implemented a minimum asset requirement today, (friends and family of an existing client are not subject to minimums) that minimum is a far cry from the asset minimum that most firms require which has typically been $250k and is now growing.The WSJ had two articles here and here that chronicles how large organizations such as UBS and Bank of America's Merrill Lynch are indicating to their advisors that they want $1 million and above in assets per client and not the previous standard of $250k. Merrill Lynch wants its advisers to move accounts smaller than $250,000 to Merrill Edge, its online and telephone-based advice service, where assets under management have grown to $109 billion since it was created in early 2011.This move that firms are making to shift clients to more of a robo advisor role as opposed to the ability to meet and talk with an advisor one on one is a choice that is largely bottom line related. With other revenue streams down for these big financial institutions, they need to find other sources of income to boost their bottom lines.In choosing to go this route, institutions are likely doing so at the expense of people who really do need sound financial advice no matter what their asset levels may be especially those who do fall under the $250k threshold. I would argue that people with lower levels of assets are in need of greater financial advice because they are probably dealing with an assortment of financial issues such as saving for retirement and/or college, repayment of student loan debt, or an overextension of credit card debt.Because I am a Registered Investment Advisor, I have a fiduciary responsibility that legally obligates me to act at all times for the sole benefit and interest of the client. Yes, investment advisory firms do have a for profit business to run, but that should never come at the expense of the client. Regardless of whom you may work within managing your assets or developing a financial plan, that person should always be a Registered Investment Advisor. Other designations such as a Certified Financial Planner and Chartered Financial Consultant are helpful but not required.Recently I started working with the daughter of a long-time client who just graduated from college. She fits perfectly into the scenario that I previously described because although she didn't need someone to manage her assets (which would automatically disqualify her from most if not all firms), what she really wanted and needed was some guidance on basic financial planning principles. I don't see how a robo advisor or someone over a phone would be able to provide this type of service at a level that is valuable for the client?According to this Financial Advisor article, Vanguard states that advisors can add as much as 3% to a client's portfolio. In a recent paper, Vanguard says advisors can generate returns through a framework focused on five wealth management principles. But Vanguard notes that while it’s possible all of these principles could add up to 3% in net returns for clients, it’s more likely to be an intermittent number than an annual one because some of the best opportunities to add value happen during extreme market lows and highs when angst or giddiness can cause investors to bail on their well-thought-out investment plans.It is likely that an advisor truly helps their client in times of absolute panic vs. trying to time the markets. You can see from the chart below (hat tip to Josh Brown @ The Reformed Broker) that discipline has paid off through the ups and downs of the equity markets. I believe (and am probably biased here) that the real value an advisor provides is the ability to help clients maintain a long-term perspective and a disciplined approach to planning and investing. This is also the hardest aspect of an advisor's job.